SEO for Financial Advisors

A simple (but effective) step-by-step guide to build a targeted SEO financial marketing strategy.

What is SEO for financial advisors?

Search engine optimization (SEO) is the process of enhancing a website or web page to improve its visibility on search engines like Google and Bing.

SEO is crucial for any financial advisor aiming to attract more clients. The higher your website ranks on Google, the greater the likelihood that a potential client will find your services and reach out.

Think of SEO like financial planning for your website.

Just as financial planning involves managing your resources for long-term success, SEO involves ensuring your website is ‘healthy’ and optimized. In other words, it helps your website get discovered by search engines, driving more traffic and ultimately more clients to your practice.

Did you know?

- 99% of people use the internet to search for local businesses. (Source: BrightLocal)

- Consumer use of Google to evaluate local businesses has leapt from 63% in 2020 to 81% in 2021. (Source: BrightLocal)

- Mobile devices are used for over 50% of all online searches. (Source: Statista)

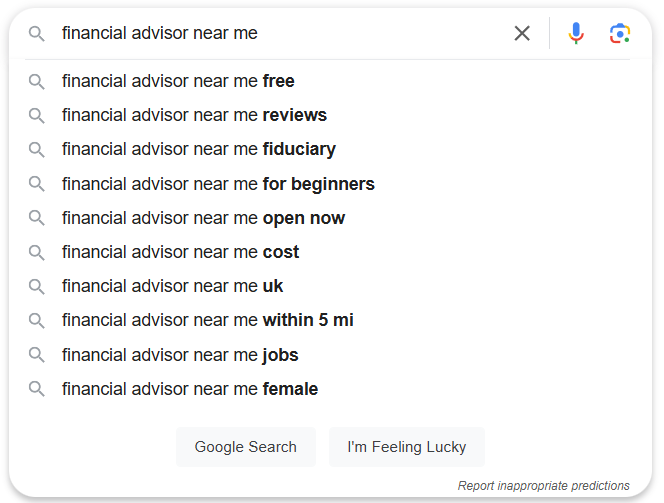

A person searching for a financial advisor on Google may use queries like “financial advisor near me” or “best financial planner in [city name]”.

They may also search for specific services, such as “retirement planning advice” or “investment management services”. Some may even include specific criteria, like “fee-only financial advisor in [city name]” or “tax planning for high-net-worth individuals”.

To benefit from SEO, your website should be optimized to rank for these types of searches, ensuring potential clients can easily find your services.

Why is financial advisor service SEO important?

Here are some of the benefits of using SEO for your financial advisory practice:

- Increased visibility: SEO helps increase the visibility of your website on search engines, making it more likely that potential clients will find you when searching for financial services.

- Cost-effective: Compared to traditional advertising methods like print or television, SEO is a more cost-effective way for financial advisors to attract new clients and grow their practice.

- Targeted audience: SEO allows you to target specific keywords related to financial planning, investment strategies, and other services you offer, ensuring you reach the right audience actively seeking your expertise.

- Local SEO: Local SEO helps increase a website’s visibility for people searching within a specific geographic area. This is especially beneficial for financial advisors, as it allows you to target individuals looking for financial services in your local community.

- Building trust: SEO can help a financial advisor’s website establish trust and authority with search engines and potential clients by providing high-quality, relevant content. This can attract new clients and help build a strong reputation in your local market.

Don’t forget!

Financial advisors must comply with regulations such as the SEC’s Advertising Rule, the Dodd-Frank Act, and data privacy laws like GDPR. Therefore, SEO and marketing strategies must be carefully aligned with these compliance requirements while effectively reaching target audiences.

How do search engines work?

Search engines work by crawling billions of webpages with their own web crawlers, known as search engine bots or spiders. These are then stored and saved in an index.

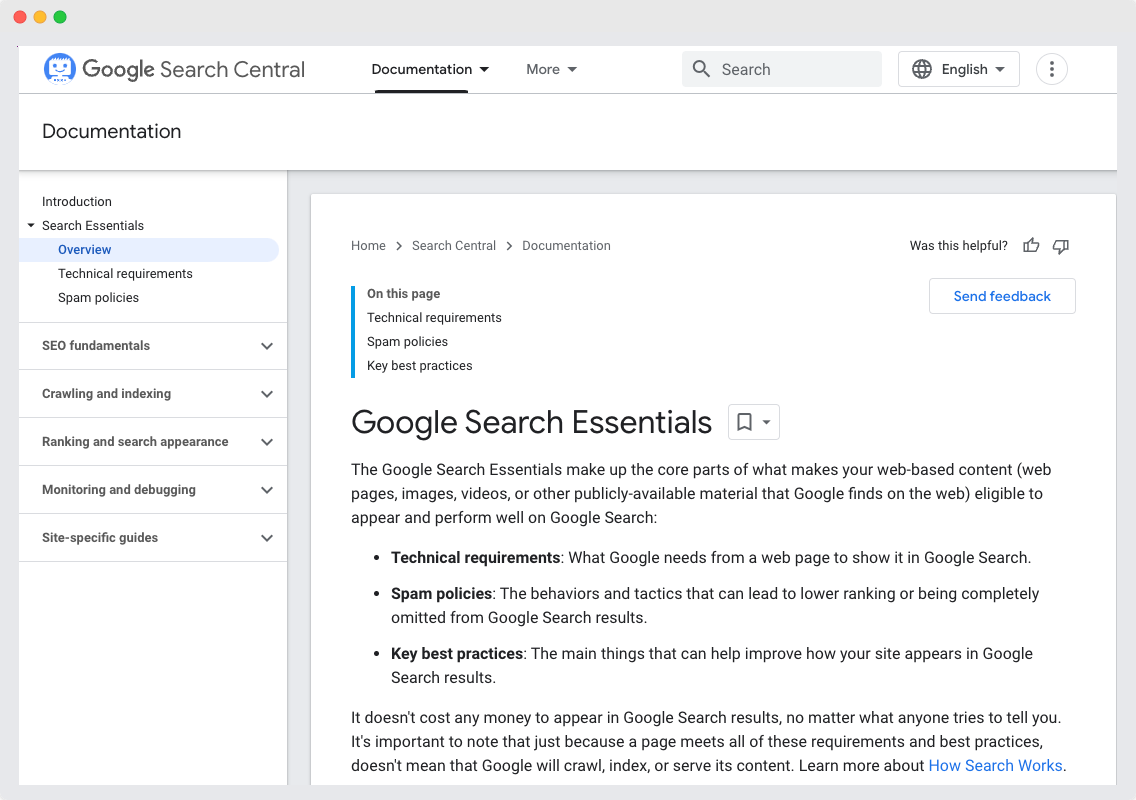

Google Search Essentials (formerly Webmaster Guidelines)

The Google Search Essentials define the actions that webmasters can take to make their websites better indexable or crawlable.

Read them here: Official Google Guidelines

The guidelines are based on three central aspects:

- Crawling – webmasters should support Google in finding websites.

- Indexing – webmasters should help Google to classify and “recognize” the content.

- Usability and user experience – webmasters should support the users of the websites in their use (usability and user experience).

Essentially, according to these Google guidelines, a website should support the search engine in crawling and indexing and ensure a good user experience.

Before you get started with SEO, there are a few prerequisites you want to check off first:

SEO Basics

At a bare minimum, you want to make sure you cover these basic standards before embarking on doing SEO:

- Website Speed – Have a fast loading site so potential customers don’t get tired of waiting for things to load.

- Mobile Friendliness – Make sure your site works on mobile as over 50% of users browse on mobile devices

- Analytics – Setup Google Analytics, Google Search Console & so you can understand what is and isn’t working.

- XML Sitemap – search engines use this to get your site’s URLs

- Robots.txt – tells search engine crawlers where they can (and where they can’t go) on your site.

Technical SEO

Technical SEO is the process of making website and server optimizations to help search engines to crawl and index your site more effectively (and therefore help to improve organic rankings).

Technical errors can hurt a website’s ability to rank. There are potentially a lot of errors, but here are some of the most common that will have the biggest impact when fixed:

- 404 errors

- Broken backlinks

- Poor URL structure

- Duplicate/thin content

- Poor internal linking

- Poor website architecture

- Missing metadata (page titles & meta descriptions)

- Missing H1 tags

Reach more clients with financial advisory SEO services

What is keyword research?

Keyword research is the process of identifying the words and phrases that people use when searching for specific products or services:

Once you understand the keywords your target audience is using, you can optimize your website to appear for these in search results.

Think of keyword research like a diagnostic tool for your financial advisory practice. Keyword research helps you understand what potential clients are searching for when they need financial services.

For example, if people are searching for “retirement planning advice” or “best investment strategies,” this information allows you to optimize your website with these relevant keywords. This way, your site can appear higher in search results when people search for those terms, helping you attract more clients who are looking for the services you provide.

Why is keyword research important?

Keyword research is important for financial advisors because it helps to:

- understand what people are searching for when they are looking for financial advice services, and to optimize their website accordingly.

- identify the specific needs and pain points of their target audience, which can inform the content they create and services they offer, ultimately leading to more conversion and better client experience.

- identify the competition in the local area and understand what they are doing, so they can create a more effective SEO strategy.

What keywords are best to target?

Understand that there’s no “best” keywords, just those that are highly searched by your audience. With this in mind, it’s up to you to craft a strategy that will help you rank pages and drive traffic.

The best keywords for your SEO strategy will take into account relevance, authority, and volume. You want to find highly searched keywords that you can reasonably compete for based on:

- The level of competition you’re up against.

- Your ability to produce content that exceeds in quality what’s currently ranking.

Short tail keywords are broad, general keywords that are made up of one or two words:

- Financial planning

- Investment advice

- Retirement planning

- Wealth management

- Financial advisor

Whereas long tail keywords are more specific and longer phrases that are made up of multiple words:

- Best financial planning services for retirement

- How to invest for long-term wealth

- Top financial advisors near me

- Wealth management strategies for high-net-worth individuals

- Tax planning advice for small business owners

How to do keyword research for your financial advisory practice

To start keyword research: put yourself in your customers shoes.

What words, phrases and terms might they use in order to find solutions to these problems? These are the keywords you want to find and target.

Here is a simple process to follow:

Step 1) Make a list of broad topics

Create a list of general topics related to your business. These might correspond to product categories, services or anything you believe your target audience would be interested in.

For example, broad topics like:

- Retirement Planning

- Investment Strategies

- Estate Planning

- Tax Optimization

- Wealth Management

Step 2) Expand topics into a list of phrases

Now you want to take those topics and expand them into a list of related phrases to target.

Imagine yourself as a buyer looking for your product or service and ask yourself: what would I type into Google?

Whilst keyword research tools are useful here, you can do this for free by Googling your keyword.

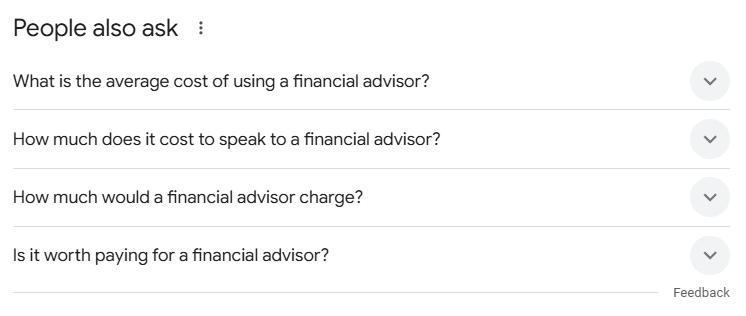

For example, Google “retirement planning”, and you’ll see related questions people ask, like “How much do I need to retire?” or “What are the best investment options?” Answering these in blog content improves SEO and positions you as a trusted financial advisor.

As well as related searches which may uncover other keywords to target:

Step 3) Analyze your keywords

Once you have a list of potential keywords, you need to gauge which terms are worth targeting.

You’ll need to use a keyword research tool here to pay attention to the following keyword metrics:

- Search volume

- Trends

- Search value over time

- Difficulty

- CPC

- SERP features

But most importantly, you want to consider relevancy and search intent:

Relevant keywords:

For relevancy, you want to ask yourself:

- Are these keywords relevant to my business?

- Do I have a chance of ranking for these terms based on the competition?

- Is ranking for these keywords going to have a positive ROI?

If you can answer YES to the above questions, chances are you have picked a relevant keyword

Search intent:

Search intent is the goal and purpose of a search query in Google. When someone searches for something, they are typically looking for more information before performing an action.

Search intent falls in four buckets:

- Informational – Searchers looking for information, they’ll use words like: how, what, why, when etc.

- Navigational – Searchers trying to find a specific site, they’ll use words relating to the service/product/brand

- Transactional – Searchers looking to purchase, they’ll use words like: buy, cost, pricing, cheap etc.

- Commercial investigation – Searchers researching prior to making a purchase, they’ll use words like: best, review, comparison etc

Not only is it important to select good keywords, but also to pick keywords you have a chance of ranking for.

If you’re a financial advisor trying to rank for a keyword like “Retirement Planning Checklist”, but your page doesn’t actually include a checklist, you may struggle to rank well in search results. Google prioritizes content that matches search intent, meaning if users expect a clear, step-by-step guide and your page only offers general advice, it won’t be as effective.

To improve rankings and engagement, structure your content in a way that aligns with what users are searching for.

For example, if targeting “Investment Strategy Checklist”, ensure your page provides a structured list of key investment steps, rather than just discussing investment principles in a general sense. Adapting your content to match search intent will increase its relevance, improving both SEO performance and user experience.

Find profitable financial advice keywords

What is on-page SEO?

On-page SEO describes specific elements of the pages on your website that you control, such as:

- Title tags

- Meta descriptions

- Header tags

- Internal linking

- Images

- Content

Why is on-page SEO important?

On-page SEO is essential for financial advisors because it ensures that their website is easily discovered and understood by search engines, which can improve visibility and drive more traffic. This can ultimately lead to more clients for the advisory practice.

For example, if a financial advisor specializes in “retirement planning” but that service is not mentioned on the website or not emphasized, it will be less likely for the website to appear in search results when someone searches for “retirement planning” or related terms. However, if the advisor optimizes the website with “retirement planning” as a focus keyword, it is more likely to appear in the search results, attracting clients specifically looking for that service.

Moreover, on-page optimization can enhance the overall user experience of a website, leading to higher engagement and conversion rates. For instance, a well-organized and easy-to-navigate website with clear calls to action such as “Schedule a Consultation” will be more likely to convert visitors into clients.

On-Page SEO Checklist

- Use short & descriptive URLs – this helps people searching to understand what your page is about in Google.

- Write a good title tag & meta description – these show up in Google and help searchers understand what your page is about.

- Linking to relevant resources – this helps users to navigate your website.

- Optimize your images – give them a descriptive filename and alt text.

- Add schema markup – this helps search engines to understand your content

- Add internal links – these help Google understand what your page is about and to navigate your website.

Get actionable insights into your financial advisor SEO

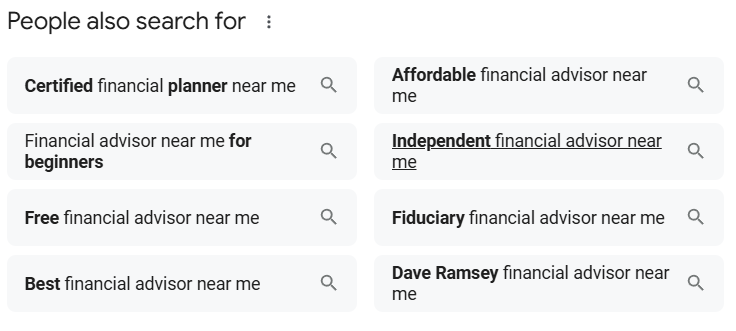

What is off-page SEO?

Off-page SEO refers to specific actions done outside of your website, such as getting backlinks from other websites or social media.

What is link building?

Link building is the practice of building one-way hyperlinks (also known as “backlinks”) to a website with the goal of improving SEO. Common link building strategies include content marketing, building useful tools, email outreach, broken link building and guest posts.

Why is link building important?

Link building is important for financial advisors because it helps to increase the visibility of a website on search engines. Google, for example, use links to a website as a way to determine the authority and trustworthiness of a website.

The more high-quality links that point to a website, the more likely it is to be considered an authority in its field and be given higher rankings in the SERPs (search engine results page).

This increased visibility can drive more traffic to a website, which can lead to more clients for the financial advice practice.

Link Building Tactics:

- Guest posts (either DIY it or use a done-for-you guest post service)

- Buying backlinks (like authority links)

- Content marketing (like linkable assets or editorial links)

- Tried and tested SEO methods (like blogger outreach, broken link building

- Using what you’ve got (link reclamation and brand mentions)

Additionally, link building can help establish a financial advisory practice as a reputable and trustworthy provider of financial services, which is crucial for attracting new clients. High-quality links from respected websites in the finance industry can signal to potential clients that the advisor is a well-regarded expert in the field.

Link building can also drive referral traffic to a website, where visitors come from links on other authoritative websites. This can boost brand awareness and reach new audiences who may not have otherwise discovered the services.

In summary, link building is essential for financial advisors because it increases visibility, builds reputation and trust, and drives more referral traffic to the website, ultimately leading to more clients.

Get high quality backlinks

Financial Advisor SEO Best Practices (+ 4 Tips)

- Use HTTPs (SSL certificates)

- Make sure your web site pages load fast

- Target a relevant topic that has traffic potential

- Meet search intent

- Target a topic you can compete for

- Use your target keyword in your page title, H1 tag and URL

- Use a short (but descriptive) URL

- Write a good title tag and meta description

- Optimize your images

- Write good content

- Add internal links

- Get more quality backlinks

4 Actionable Finance SEO Tips

Here are some things your practice can do to begin the process of developing a good financial advisor marketing strategy.

- Add relevant keywords

- Optimize for local searches

- Start blogging

- Earn links

1. Add relevant keywords to your website

People searching for financial advisors often look for specific services like retirement planning or tax strategies. Long-tail keywords typically have fewer searches, but the traffic generated from them is often highly targeted and more likely to convert into real clients.

For example, instead of only optimizing your website for broad terms like “financial advisor” or “financial services,” you could target keywords like “retirement planning advisor in [your city]” or “tax planning services in [your area]” or “investment advice in [city], [state]” to attract more relevant, local traffic.

2. Optimize your site for local searches

If your SEO plan doesn’t use local SEO to target specific areas, you’ll likely miss out on some great leads. Adding the name of your town and nearby towns to your website copy is the easiest way to get better results.

But don’t forget about things on your site besides writing copy. You should also add places to the titles and URLs of your pages.

Also, make sure that your business is listed on Google Maps and local directory sites. This will help your business show up more in local searches.

3. Start writing useful content

The main goal of financial advisor practice SEO is to get more clients by making your website more visible in Google.

One effective strategy is to write a blog. By posting articles with tips on topics like retirement planning, tax optimization, or investment strategies, you can attract interested readers who may eventually become clients. As your traffic grows, so will your search rankings, and people searching for financial advice in your area will begin to see you as a trusted and reliable resource.

4. Earn quality links

How high your site ranks in search results for keywords and phrases related to your business depends on how many and how good the links are to it. This means that you need to get good links if you want to keep your rankings.

You can do this by making good content and reaching out to bloggers and leaders in your field to ask them to share it. This will not only help you move up in search results, but it will also make your financial advice practice look like a leader in the field.

Backlinks are a very important part of SEO for financial advisors. They are like a vote of confidence for the content your practice puts out. Because of this, links are one of the most important ways that search engines like Google decide how to rank pages.

- Not doing enough keyword research

- Not matching user/search intent

- Targeting keywords that are far too difficult

- Not building enough quality backlinks

- Breaking Google’s Terms of Service when building backlinks

- Missing out on internal link opportunities

- Not allowing Google crawl your content

- Not allowing Google index your content

- Having a very slow site

- Treating SEO as a one-time thing

How does financial advisor SEO work?

SEO for financial advisors means making sure that your website is optimized for both search engines and users. This makes your website more visible in relevant and organic search results.

Optimizations include:

- on-page SEO

- link building

- technical SEO review

- content audit

- local citation audit

Why do financial advisors need marketing?

It helps set your practice apart.

Your clients are your customers. A marketing plan not only helps you identify your target market but also helps potential clients understand why they should choose your financial advisory services.

A strong marketing strategy should attract new clients, retain existing ones, and increase awareness of your offerings. The main goal is to get prospective clients to reach out for a consultation or schedule an appointment online.

How long does financial advisory SEO take?

Typically, financial SEO takes at least six months to deliver results.

In some cases, practices may start to see results like increased traffic, phone calls, and appointments, in faster time frame than this.

Although typically 6 months is a good benchmark as SEO is a long-term strategy vs. a short-term strategy like PPC.

How much does SEO for financial advisors cost?

Prices for financial website SEO depend on multiple factors, but the average cost for financial advice SEO is $1500 – $5000 per month.

If you’re looking to partner with a consultant or financial advisor SEO expert, the average rate is $100 – $300 per hour.

What’s Next?

Guest Posts

We do guest posts better than anyone else with complete transparency. You get to approve all placements before they’re made and even the exact anchor text that’s going to be used. Site owners themselves will produce your content to guarantee its a perfect match.

Content

Crafting the right message isn’t just a matter of choosing the right words. We develop site content and blogs using the latest tools to determine the right keywords and balance of terms to build high-performing content.

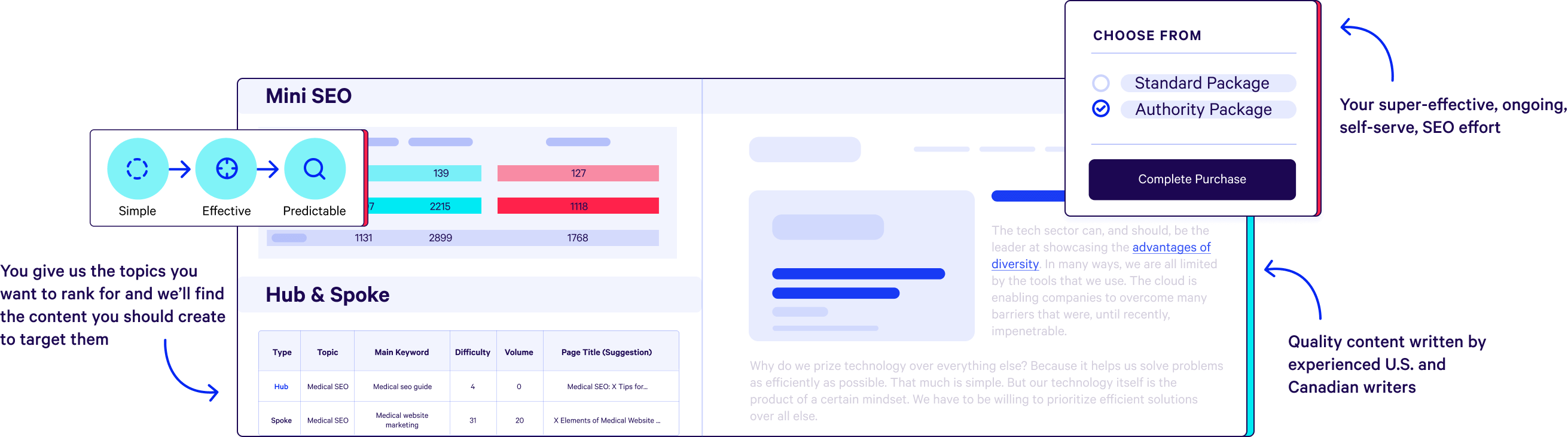

Managed SEO

Sometimes, it takes more than just one service to make a difference. Multiple services working in concert can amplify the effect and create the growth that’s evaded you in the past. Talk to us about managed SEO campaigns built around any of your goals.

Too busy running your financial advisory practice to do SEO?

Grow your business with a monthly SEO package focused on building quality backlinks to your highest priority pages.